refinance closing costs transfer taxes

Other states charge a fee everytime there is a new mortgage recorded. They can be as low as a flat rate of 2 as it is charged in Arizona or a percentage of the sales price that can exceed 2 percent according to.

No Closing Cost Mortgage Is It Actually Worth It Credible

Taxes account for as much as 60 of closing costs in the Capital Region.

. From your response I interpret you to be saying that these closing costs can be added to my basis. But home buyers and sellers should note that many local jurisdictions impose their own additional transfer tax in addition to the REET. The home was refinanced 5 times during that period and I paid in the vicinity of 2800 per refinance for non-deductible closing costs primarily title insurance escrow and recording fees.

275 on homes between 1500000 and 3000000. It does not apply to refinances in PA but the lender may have a. Top Real Estate Agents in Washington.

Escrow costs for property taxes and homeowners insurance Your closing costs will vary depending on the new loan amount your credit score and. Transfer tax is assessed as a percentage of either the sale price or the fair market value of the property thats changing hands. States with no transfer taxes.

20 cents per 100 Intangible Tax County Tax on the mortgage. ClosingCorp reported an average of just 2375 for refinance closing costs last year. When the same owner s retain the property and simply.

Average refinancing closing costs are 5000 according to Freddie Mac. 70 cents per 100 Documentary Stamps State Tax on the Deed 35 cents per 100 Documentary Stamps State Tax on the mortgage. Tax-deductible closing costs can be written.

For instance the transfer tax in North Carolina is described as 100 for every 500 a rate of 02. How to Pay Closing Costs When Refinancing Your Mortgage. View recordation taxes collected from borrowers at closing as part of a home loan refinance in DC MD or VA along with recording fees.

State Recordation or Stamp Tax see chart below County Transfer Tax see chart below Borrower pays on the difference of. Closing costs on a 100000 mortgage might be 5000 5 but on a 500000 mortgage theyd likely be closer to 10000 2. A transfer tax is assessed in 37 states and in theDistrict of Columbia and it can vary widely.

You cant deduct more than 10000 per year 5000 if married filing separately in property taxes sales taxes and state and local income taxescombined. For example if you spent 15000 on closing costs for a 15-year refinance youd deduct 1000 a year until your loan matures. State laws usually describe transfer tax as a set rate for every 500 of the property value.

Those costs however tend to be much lower. The national average closing costs for a single-family property refinance in 2021 excluding any type of recordation or other specialty tax was 2375. For 2020 tax returns filed in 2021 the standard deduction is 12400 for individuals 18650 for heads of household and 24800 for.

Mortgage closing costs typically range between 2 and 6 of your loan amount. I also had to pay for appraisals each time. When youre determining what to claim on taxes it helps to know the IRS rules.

3 on homes more than 3000000. 1 hour agoIf you refinance your mortgage closing costs typically range from 3 to 6 of the loan amount. First you should know the current standard deduction amounts.

In addition closing costs are often a smaller percentage on a. Typical closing costs for a buyer of a 250000 home might range between 5000 and 12500. State Transfer Tax is 05 of transaction amount for all counties.

Purchasing A Home In Florida Florida Refinance. You can write off some closing costs at tax time. Closing Disclosure - Refinance Title Fees ALTA Loan Policy Total Title Fees Closing Costs Settlement Fee Search Fee Title Binder Fee Update Record Payoff Processing Payoff.

Many states charge a feetax when a home is sold sometimes that is paid by the seller sometimes by the buyer. Because each persons tax situation may be different you may want to consult a tax professional for specific guidance. 128 on homes between 500000 and 1500000.

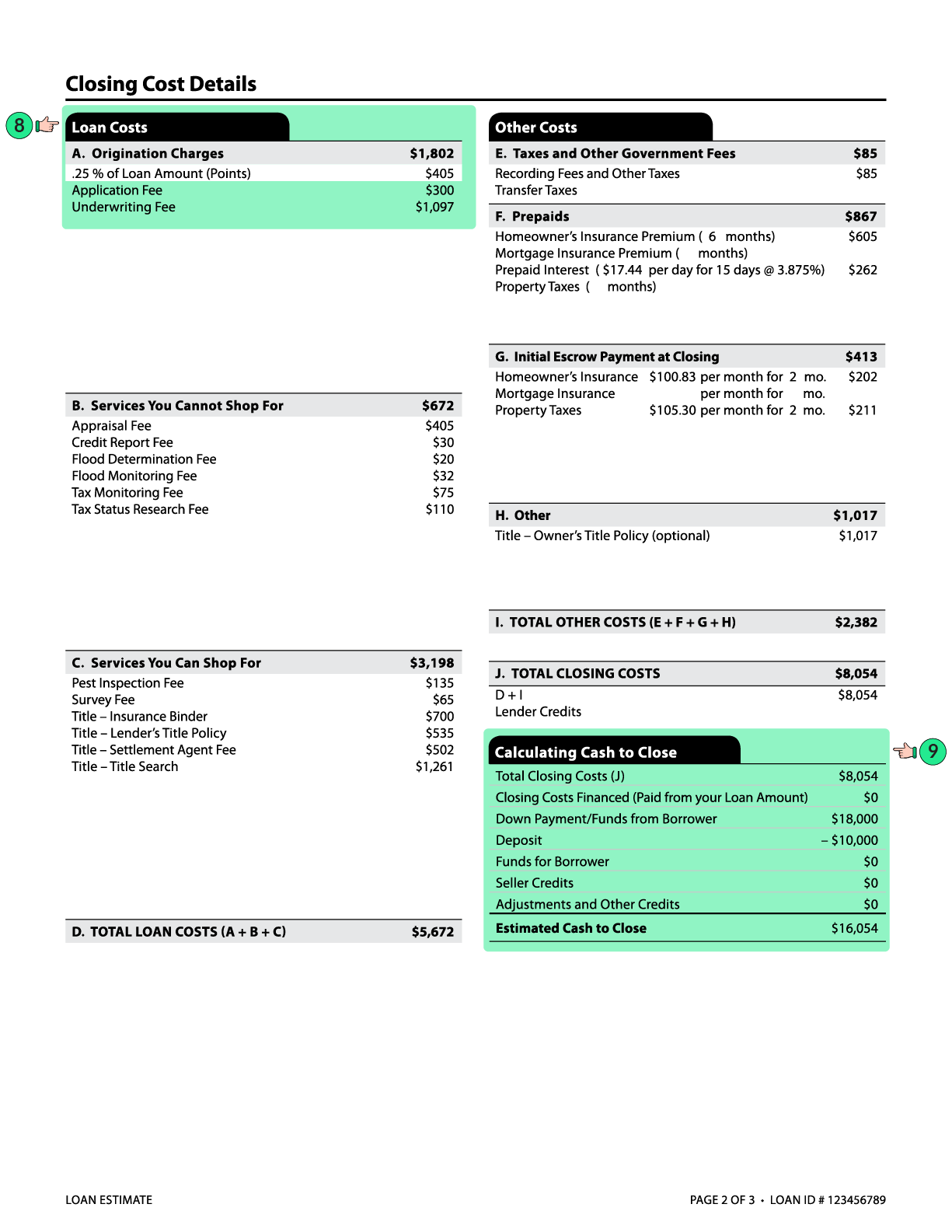

What Is A Loan Estimate How To Read And What To Look For

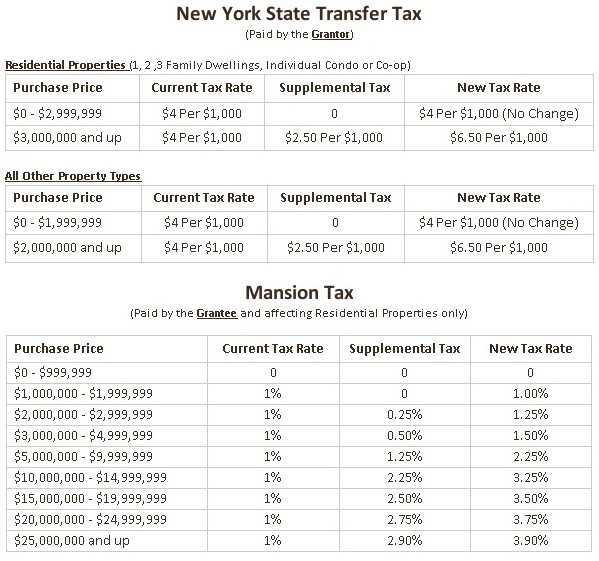

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Closing Costs Ontario You Must Know Before Buying Or Selling Property

Refinance Closing Costs Remain At Less Than 1 Of Loan Amount In 2021 Corelogic S Closingcorp Reports

Real Property Transfer Tax Increase The Judicial Title Insurance Agency Llc

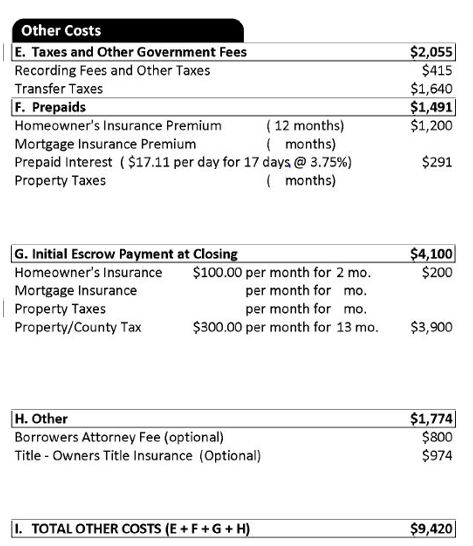

What Is A Loan Estimate How To Read And What To Look For

What Are Real Estate Transfer Taxes Forbes Advisor

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Refinance Closing Costs Calculator Shop 50 Off Www Ingeniovirtual Com

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

What Is A Real Estate Transfer Tax The Civic Federation

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Refinance Closing Costs Calculator Shop 50 Off Www Ingeniovirtual Com

Closing Costs Why They Matter And What You Will Pay

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro